Record an Expense Against a Job

Expenses are used in Ascora to record and track miscellaneous costs associated with a Job that aren’t typically on-charged to a Customer. Examples could include parking or meal expenses.

1. To add an Expense to a Job, choose the Supplies Tab on the Job Details and scroll down the screen to the Expenses section. Click the +Add Expenses button.

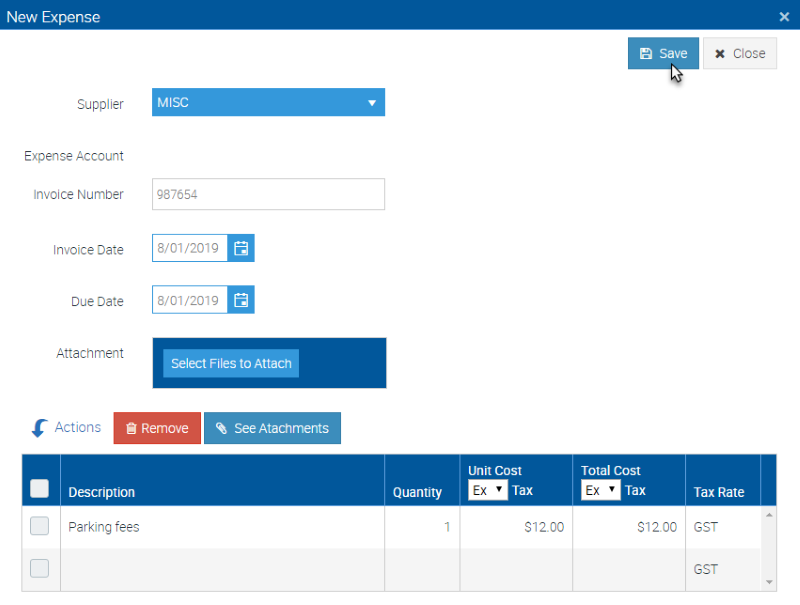

2. The New Expense pop-up window will display, allowing you to record the details on the Expense:

- Select a Supplier from the dropdown list

- If you have integrated Ascora with your accounting package, an Expense Account dropdown list will display all Expense or Cost of Goods sold Accounts that exist in your chart of accounts.

- Enter the Invoice Number for the expense

- Select the Invoice and Due dates

- You can optionally choose to attach a file – for example, a photo of a parking receipt (Note: If you are integrated with Xero, Ascora will automatically push this attachment across as well).

- Click in the Description box to type a description for the Expense

- Click in the Quantity box to enter a quantity for the Expense

- Enter a Unit or Total Cost (inclusive or exclusive of tax)

- When you are ready, click the Save button

Note: If you have linked Ascora with your Accounting Package, when you click Save, Ascora will automatically push expense across to your Accounting System as a Supplier Invoice / Bill.

The Financial Summary on the Job Details will display the Total of all Job Expenses along with Labour and Material Costs so you can see in real-time how your Job's are tracking.